5 behavioral biases you should know 🎭 - Music x Economics with an Ex-Spotify 🎼- Writing a Substack newsletter 📝- Who's the next Tesla? 🌱- Crypto future 🏦

Experts share their key insights, every week 💡 Curators are the new creators

Hi, it’s Gilles from Clind, a brand new app where your personal knowledge management becomes cool and easy. The Timestamp is a weekly newsletter featuring insights from experts sharing their knowledge and helping you read less and learn more. Today, I’m sharing 5 great takeaways we have seen in the app Clind during the past week. Topics we cover this week include Music x Business x Writing x Wellness x Tech x Finance.

Let’s get started and please share The Timestamp to help us get even more than 2500 readers.

#1 Know your behavioral biases from this article 👇

5 Behavioral Biases that trip Up Remote Managers published on June 1st 2021 in the Harvard Business Review and curated by Laura Bokobza

In a recent Harvard Business Review article, three behavioral scientists shared five common biases managers should be aware of—especially when working remotely—and how to overcome them.

1. Confirmation bias: Seeking out info that supports your own views, versus keeping an open mind.

2. Attribution bias: Assuming the behavior of others is due to personality flaws or weaknesses, rather than external factors out of their control.

3. Groupthink: Letting the loudest voices dominate the discussion and distort decisions.

4. In-group effect: Difficulty assimilating to a new team. This can be especially tough when onboarding remotely because there’s less opportunity for casual, more personal convos.

5. Peak-end effect: Judging an experience by how you feel at its peak or it.

Laura Bokobza is a startup mentor, advisor & board member. You can subscribe to her weekly newsletter called “Le Comment du Pourquoi” 🇫🇷. Laura is also the host of a podcast called “Revues et corrigées”.

#2 Learn the economics of the music industry from this article 📚

An Ex-Spotify Exec Breaks Down Modern Music’s ‘Tarzan Economics’published on May 5th 2021 in Rolling Stone magazine and curated by Patrick Kervern.

💡 “We cling to this vine to avoid the jungle floor”. Sometimes you have to let go the old way of doing business and jump to another vine argues Will Page former Chief Economist at Spotify in “Tarzan Economics”. But how do you identify the good one. In this business and digital story we discover how to identify market opportunities in goods like music that are “Non-excludable but still rivalrous”.

💡 The preliminary view from the top was the following finding : “Digital content is not rivalrous and never will be”. Then the first insight was that in the music business, streaming had created an opportunity and that opportunity was : access not ownership. “When the majority of the population isn’t buying” you should optimize for reach rather than revenue. Argues Will Jones who pioneered with others the Spotify model?

💡 The result speaks for itself : in 1999 -before the Napster effect - the ARPU (average revenue) of a music buyer was 63 dollars. Today with Spotify it is 81 dollars.

Patrick Kervern, Founder at UMANZ. Sense-Maker & Curiosity expert.

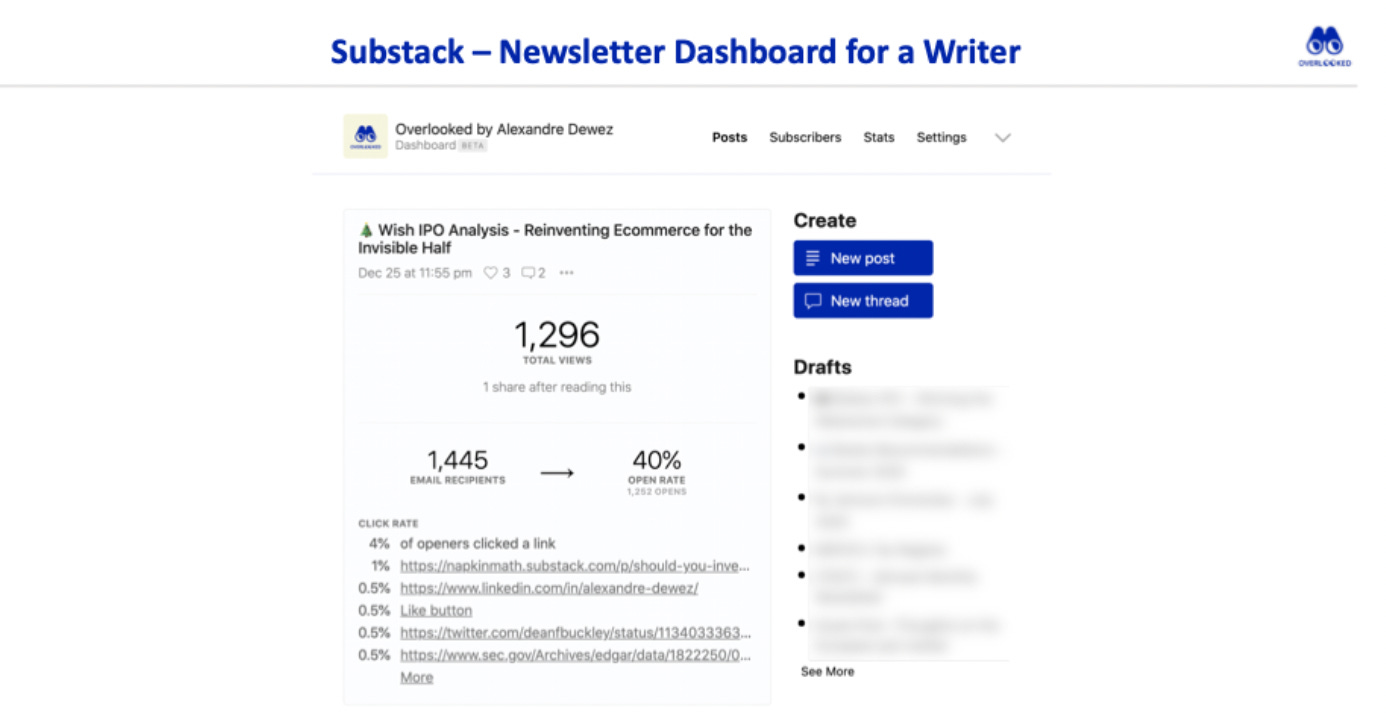

#3 Start and grow your substack newsletter looking at the data📝

Overlooked’s 2020 Annual Review published by Alexandre Dewez on Jan 4th 2021 in the newsletter Overlooked and curated by Christian Riedi.

💡 A hardcore reader is someone who opened 5+ times a given newsletter. I look at the percentage of hardcore readers in comparison with subscribers. I consider that I have a product-market fit when a sub is a core reader of a given newsletter. The idea is that if I can reach out to them to talk about the topic and they should be super happy to have a chat.

💡 At the same time, I'm convinced that the weekly frequency is key to become successful. I was inspired by French Youtubers McFly & Carlito to choose this cadence. Their Youtube channel has skyrocketed when they decided to publish a new video every Sunday at 10 am. The idea was to create a rendez-vous with their audience with the funny ambition to replace the Sunday Mass. In the newsletter game, the weekly cadence increases the chances that a post will go viral.

Christian Riedi, Business Angel & Writer at his newsletter Le Wrap Up 🇫🇷. x-Directeur Développement @TF1 with 15 year experience in media. You should check his newsletter as well if you like curation.

#4 Who’s The next Tesla from this article 👇

How to be the next Tesla published as a paid article on June 5th 2021 in the Economist and curated by Julien Triverio sharing his free takeaways.

Main electrical vehicle (EV) competitors by regions: 🇨🇳 China : Aiways, Li Auto, Nio, wm Motor and Xpeng. 🇪🇺 Europe : Rimac, Hispano Suiza, Arrival. 🇺🇸 US: Canoo, Fisker, Lordstown, Lucid and Rivian. Most of them are loss-making. Investors are looking for the next Tesla, there is a lot of candidates thanks to a lot of liquidity + SPACs, however will need to survive first. Basic survival plan for EV challengers: - start from niche then expand - produce cars at scale - create sales and distribution network.

Geographic focus: China looks to be the best spot to start with gov keen to support electrification and consumers hungry for new tech. Market Segment: hot competition (crowded) in premium SUVs. Next opportunity, in light commercial vehicles (delivery vans), boosted by the e-commerce boom. But challengers must focus on tech to differentiate, the industry is becoming more software-oriented.

However they will face "production hell" as Tesla did, they still need assembly lines to manufacture an EV (which is costly). Can be outsourced (e.g. Fisker, Nio) or build new partnerships with experienced players. The final hurdle is distribution, Tesla has 135 dealerships while big 3 Detroit have 10k... But many new firms won’t get that far as run out of ideas/money. Big next player, should establish a brand with reliable products (take years and a lot of cash), Apple ?

Julien Triviero, Multi-Asset Investment Manager at State Street Global Advisors. Julien helps clients to achieve their investment objectives and meet their risk targets.

#5 The future of Crypto from this article 👇

The boundery between crypto and fiat money is becoming more permeable published as a paid article on May 29th 2021 in the Economist and curated (yes again) by Julien Triverio.

There is 2 different point of view in finance currently: - Crypto kids, blockchain-based finance is the future, - Central bankers, titanosaurs of the fiat world.

Crypto, like gold, is built on collective belief about its value. People act tacitly in concert, if they know that others are trying to do the same (= focal point). This insight applies to certain assets that lack intrinsic value e.g. crypto and gold. Their value is bolstered by scarcity and longevity. Bitcoin is newer but similar to gold in a certain way. Yes, blockchain is ingenious and yes bitcoin is used in transactions... but selling points are scarcity and fame (=natural focal point).

Observed recently, money flowing out of bitcoin futures/ETF while money coming into gold ETFs. Can be seen as relative value trade within inflation hedge tools. Market Cap of crypto is $1.5b as the end of May ($1bn lower since its peak mid-May) As crypto assets are highly speculative and their prices are a signal of shifts in risk appetite.

Julien Triviero, Multi-Asset Investment Manager at State Street Global Advisors. Julien helps clients to achieve their investment objectives and meet their risk targets.

Thanks for reading! This newsletter is free, but if you’re feeling generous you can support this work by subscribing to some exclusive content.

Take care and see you next Sunday or before with some exclusive content for our paid subscribers ;)