Clever Mind: The Top 5 curators of the week 🏅- Post Covid Education 🎓- Nobel prize new book 📚- Ready Player 1 is now real 🕹- Green bubble ? 🧮 - When passion leads to burn out 💘

5-minute coffee break brought to you every week by human experts

Dear reader of The Timestamp, we are disclosing a new Top-5 selection of the best curators of the week. This week, you are getting the very best of our very good curators posting their key takeaways in the app Clind 📲.

If you're feeling like your day is just that bit more exciting, then scroll down to find out everything you need to know about Edtech, the new book you should read from Nobel Prize in Behavioral economy, the Future of Gaming, Marketing tips for creators and Wellness in the workplace.

With 2500 subscribers reading The Timestamp every week, we're expanding and growing with more content for our community to enjoy.

Would you like to be featured in the next edition of The Timestamp ? Who wouldn't love to get their work featured on a website with 2500 subscribers and growing?

👉 Just pick your expertise or passion, save your fave content into the app Clind (iOS and Play mobile stores) and start writing your first takeaways 📝.

If you think of someone who would be interested in being selected by The Timestamp, you can also share it.

#1 Is Edtech a risky bet with Mehdi Cornilliet from this article from Techcrunch

Edtech stocks are getting hammered but VCs keep writing checks published on May 14th 2021

🎢 Compared to its 52-week high, Chegg stock has lost over a third of its value. After reaching $62.53 per share in April, Coursera has shed about half of its value and is trading close to its $33 IPO price. 2U closed at $33.92 per share yesterday, its shares also losing half of their value compared to their 52-week high. Staying on that theme, Stride (K12) closed at $26.77 per share yesterday, which is about half of its 52-week high. It wasn’t just U.S.-based companies facing some volatility. TAL

💡In September 2020, Larry Illg, CEO of Prosus Ventures, told us that edtech was filled with “tourists” and “faddish money,” making it a hard time to assess companies and find accountable bets.

💡The investor then predicted that there would be carnage in edtech but noted, like many in the space, that the mindset shift among parents and educators alike was that edtech is the future — even if only a relatively small handful of consumers wind up paying for its products and services.

Mehdi Cornilliet is an entrepreneur in education (co founder @2Empower, a media group for ambitious students ) & Writer of a newsletter La Revue Edtech 🇫🇷. If you are into EdTech, you should definitely subscribe to his newsletter.

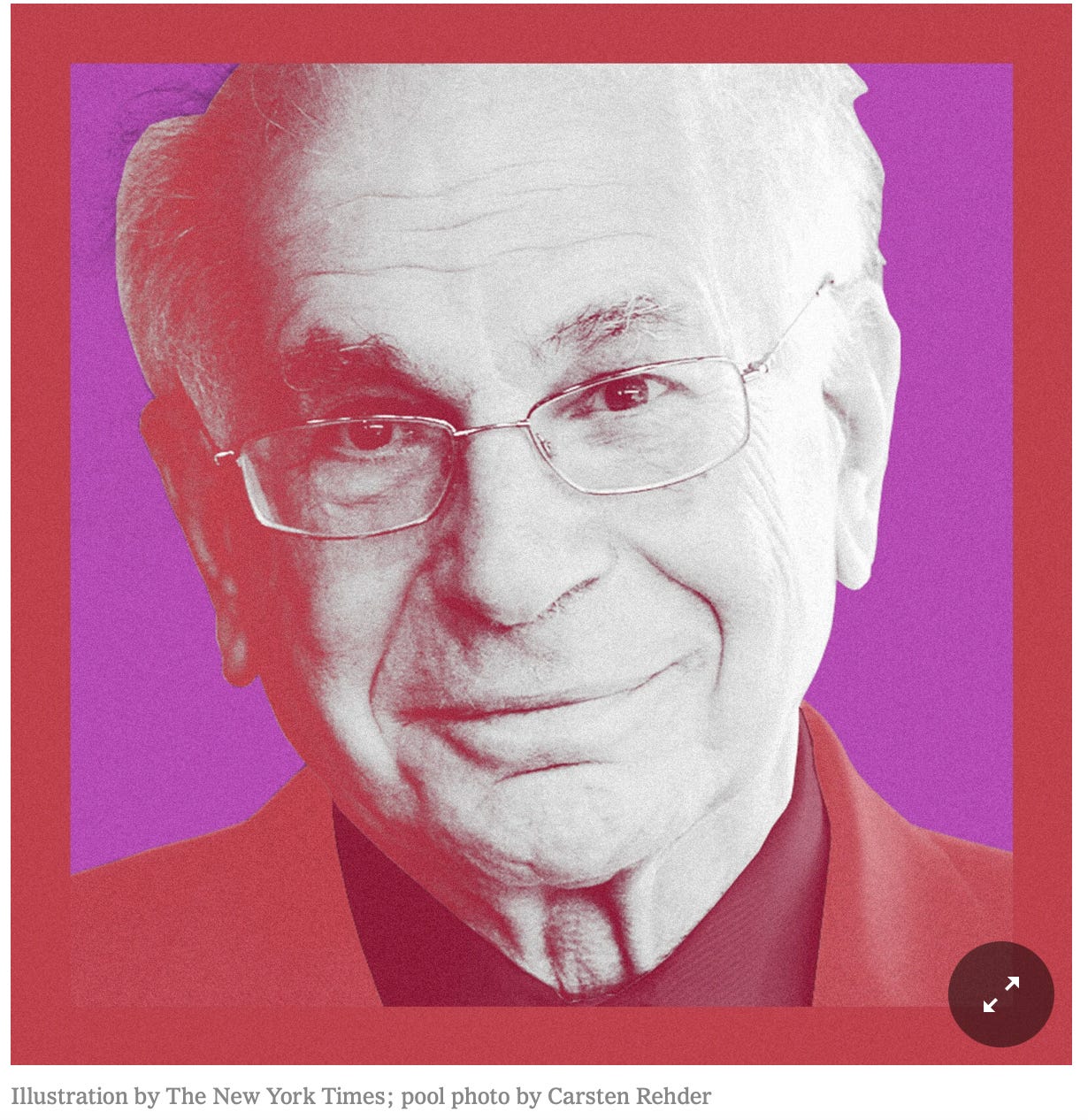

#2 How We Can Reduce Noise and Prevent Our Decisions From Becoming Unfair ? with Christian Riedi from this podcast from The New York Times 🎧

Daniel Kahnneman Says Humans are Noisy published on May 17th 2021

💡Daniel Kahneman’s new book -> Noise : unwanted variability / system noise.

Noise vs biases : noise can be quieted, biased. Noise is easier to fix, you can measure it without knowing the correct answer. Noises are unshared errors therefore non foreseeable degrading our decisions and lastly our trust in our systems.

Noise audit : noise indecision > Asking people what the variability will be ? 10% —> 55% After thinking fast and slow (2011).

🎧 Different level of noise : fundamental differences between individuals.

Occasion noise : depending on occasion, state of mind. Taste noise : “à la gueule du client”. AI vs human judgement : they have less noise, they are more right. We are much more stringent with computers, we have a tolerance for man-made systems.

🧐 What about Prejudgement ?

We assume that in the future algorithms will make more decisions about our lives. Decision hygiene : do you want to delay intuition? Do you want to make independent opinions before confronting them sequencing information ? Delay intuition. Judgement guidelines: give a range.

Confidence about judgement is not relevant to its accuracy. Structured interviews help collect info on a sequenced ways / separate interviewers / and assemble to decide. In any decision, options are like candidates.

Christian Riedi, Business Angel & Writer at his newsletter Le Wrap Up 🇫🇷. x-Directeur Développement @TF1 with 15 year experience in media. You should check his newsletter as well if you like curation.

#3 The Metaverse is Here with Patrick Kervern from this article in Singularity Hub

Epic Games Raised $1 Billion to Fund Its Vision for Building the Metaverse published on April 14th 2021

The Oasis Dream universe of Ready Player One is about to become a reality now that Epic has set its sails toward the Metaverse with Unreal Engine version 5 whose “demo doesn’t look terribly different from a really high-quality video camera following someone around in real life” and MetaHuman Creator, an app that creates highly realistic “digital humans” in a fraction of time it used to take.

Conceived as an Evergreen & pervasive world : Epic ‘s metaverse will be active even when people aren’t logged into it, and would link all previously-existing virtual worlds, like an internet for virtual reality.

Facebook (with Facebook Horizon), Google, and Samsung have all been investing heavily in cloud computing and virtual reality but Epic has a lead because it's gamers that often own the most powerful computer processors available to consumers.

Patrick Kervern, Founder at UMANZ. Sense-Maker & Curiosity expert.

#4 Is there a green bubble? with Julien Triverio from this article in The Economist

A green bubble ? We dissect the investment boom published on May 22nd 2021

Green assets had solid returns recently from battery metals (lithium and cobalt), copper and carbon to clean energy stock: Telsa, SunRun... With fear of inflation, this boom has deflated recently but green investing is changing profoundly... overall : positive view - as energy transition wont reverse. - like internet, decarbonization will lead to structural change - capital will flow toward green businesses.

Drivers of this surge: - rise of ESG factors, => more inflows towards clean energy stocks. - Green stocks are now mainstream, not only niche for sustainable funds, and supported by retails (reddit). - many clean energy firms are now more viable. e.g. cost of solar power has shrunk (due to cost of tech being cheaper) = compete with fossil fuel firms. - Regulation : US, China and EU setting net zero emission targets.

Fears of a Green bubble ? - about 30% of green companies are lossmaking - on PE and PB metrics look expensive vs S&P500. (as green are younger companies) - higher inflation would erode future earnings hence valuations - higher rates (CB hike) could hurt green producers who rely on debt for financing. - CEO promised more their technology can deliver (e.g. Nikola) - falling product prices might offset demand growth.

Julien Triviero, Multi-Asset Investment Manager at State Street Global Advisors. Julien helps clients to achieve their investment objectives and meet their risk targets.

#5 Take care of yourself with Marine Bassieux from this article in the Harvard Business Review

When Passion leads to Burnout published on July 1st 2019

Burn-out has been as something trendy made up by millenials, and so deprioritized the last decade. The truth is burnout is a real thing : "23% reported feeling burned out at work very often or always" in a Gallup survey of 7,500 full-time employees. As the World Health Organization recognizes burnout as a syndrome in its International Classification of Diseases and the new generation is claiming for more meaningful work, the purpose-driven burnout is a real and pressing issue to address.

Certain roles are at increased risks : purpose-driven work - that is people who love an feel passionnate about their work. Mission-focused executives, non-profit employees, teachers/principals, nurses and physicians are some of the people most at-risk for burnout. It can lead to obsessive passion which predicts an increase of conflict. A Canadian study reveals more stressed, lower well-being, resilience and self-efficacy scores and beyond employees driven by purpose.

What leaders can do ? *Teach people how to set boundaries. Help people to understand the "always-on" mindset is harmful, setting boundaries -all the more digital boundaries - isn't selfish but selfless. The leaders should help, it's their responsibility Dr Caroline Elton says there are two ways :

- keeping an eye on the well-being of employees,

- raise awareness on the subject and help to recover from a burnout,

>> acquire resilience.

Marine Bassieux is a career coach and working on quality of work in the workplace.

Some others great links to great pieces shared by our top curators this week with their key takeaways in the Clind app :

- Marine Bassieux / Wellness >> You don’t have to be a CEO to be a visionary leader published in the Harvard Business Review in April 2019

- Christian Riedi / Knowledge >> Why successful people spend 10 hours a week on ‘compound Time’? from CNBC Make It

- JF Marti / Business >> Ranked: the most prominent VC investors 2021 from Dealroom.co

- Christian Riedi / Entertainment >> Slow art? It will ‘blow your mind’ from the BBC News

- Patrick Kervern / How Masterclass CEO David Rogier brought star power to online learning from Variety

- Mehdi Cornilliet / EdTech >> Spring 2021 enrollment update: the fight to heavily online institutions from Philontech

- Julien Triverio / Business >> How to thrive in the shadow of giants from The Economist

And before leaving you, we want to thank those of you who already use Clind as we are featured in the Apple App Store this week in France:

If you found this issue of the newsletter valuable, I'd really appreciate it if you could forward it to a friend, family member, or colleague who you think might enjoy it.

Or, if you'd like to share it on one of your social networks, that’s always great as well.

See you next Sunday.