Special 2022 Edition: The Timestamp is for FREE 🎁- Top3 of 2022 so far > Lead (the) Peloton 🚵🏽♂️- Get lucky ... always 🎈- Hunting dinosaurs 🦕

Be intentional about luck

Episode #63. Hey you, this is Gilles 👋🏼 The Timestamp becomes free. Yes entirely free, no funny trick.

I decided that getting to 2000 subscribers (what we have now) is great but reaching 5000 or 10000 is even cooler. The Timestamp is just my side hobby; I love writing. No need for a paywall, no blocker for growth 🚀. This means that I will stop receiving new paid subscriptions and reimburse all paying subscribers as of now. I am sending a warm appreciation to them, we can still interact in the future on our VIP Slack community.

This is the opportunity to unveil our Top3 summaries from The Timestamp; you really enjoyed (and clicked) those 3 following pieces which I am editing a bit from my first version with some personal inputs and thoughts.

New Peloton’s CEO email to employees from Twitter back in Feb 22,

Cultivating Serendipity from a Umanz episode publishing in French in Jan 22,

Prospecting and winning mega deals in SaaS: the playbook published in Feb 22.

#1. Leading (the) Peloton

My key takeaways and personal perspective on a piece written by Frederic Filloux you can access here 👉 La Saga Peloton. Frederic published this article on Feb 8, 2022. I added a summary of the Twitter post that leaked on the internal email from Barry McCarthy, their new CEO.

It is the story of a startup that was a shining star before getting into trouble. Then, a new CEO came in. We talk a lot about a possible startup valuation blast. Here is a taste of it.

What really happened at Peloton?

Since its IPO in September 2019, this emblematic sports tech from the US has known a tough ride. Worth 50bn$ at its peak, Peloton could have been listed in the French CAC40 stock market. The stock went down by -83% after the IPO.

Is this the beginning of the end for startups after a golden era of gigantic valuations?

Peloton sells luxurious treadmills to affluent people but lacks a real entry barrier. The company's P&L is very dependent on logistics.

John Foley who just left his CEO position has increased his personal wealth by more than100me dollars while the company valuation lost 40bn dollars. Is this normal after a number of decisions he took were certainly very questionable?

The big (CEO) change

John remains exec chairman while a new CEO Barry McCarthy takes over as CEO (former CEO of Spotify and Netflix).

Here is his (inspiring) message to his new team

Here is what I like in his address to the team:

First, he makes clear how good the tech is great at Peloton. He wants to build upon an impressive Net Promoter Score (aka NPS) and a very low subscriber churn rate; these 2 metrics are a piece of key evidence that the company has found the famous product-market fit. Finding product-market fit is ‘incredibly hard to do’.

Second, he explains why Peloton has to drastically change its approach toward cash management: ‘the hard truth is that either revenue had to grow faster or spending had to shrink’.

Then, Barry McCarthy lists 10 principles that will guide his method and work to turn the company around. I will just take 3 of them and comment a bit on them to share my viewpoint.

Talent density is foundational. Most startup companies and founders measure their success by the number of their employees. I fully agree that this is a pride metric that can be misleading even though size remains an indicator of wealth but… I also prefer having the best team to just having the largest team.

Fast is as slow as we can go. Sometimes, I also hear comments like “the CEO is going too fast.” Well, again I do believe that going fast is the recipe for success as long as it bears the principle that going fast also means accepting being wrong and making mistakes. ‘Done is better than perfect’ is not only a method to explore and iterate faster to the goal but it is also a principle that helps every employee to fill fulfilled every day, every week. Whatever the outcome, great or bad, everyone gets the feeling of achievement. 'Getting things done’ leads to happiness.

Your comfort zone is your own worst enemy. Interestingly, comfort is a very subjective idea. For most people, it means doing nothing or doing what you are good at; for people like me, comfort is being uncomfortable and always being active. I often say that being a CEO is like being an athlete but for the duration of a lifetime (compared to the career of an athlete that is generally much shorter). Being an employee in an ambitious startup means being able to change and grow at least as fast as the company is growing its ambition. Growing 2x or 3x your skillset every year is only possible if you keep learning and if you keep working and hiring people that are better than you are. They will make you grow faster.

#2. Cultivating serendipity 🗯

My key takeaways from an article you can access here 👉 La lettre de Umanz : les 4 filtres de sérendipité 🇫🇷 (The 4 filters of serendipity) was published by my friend Patrick Kervern on January 14, 2022.

Probably the key idea behind being lucky is… being intentional about luck.

Pasteur said « la chance favorise les esprits préparés » (Luck favors prepared souls").

I like to reflect on the people I meet and ask myself this (great) question « who is the most interesting person you met over the past 90 days? ». “How can you get back in touch with her/him?”.

I see you paused a moment to think. This is not an easy question to answer. To be honest, I feel blessed I have the feeling to meet interesting people every week, almost every day that passes. At work, meeting people at the company I joined beginning of this year or meeting prospects and customers or candidates to join the team. I force myself to meet people that do not have an obvious interest in my business or life and I very often get the surprise that we share at least one thing we share. It is just about asking the right discovery questions and follow-up.

“Ceux qui ne lisent pas de livres n'ont qu'une seule vie, les pauvres : la leur.” (Those who do not read book only have one life. Poor them. Just theirs) once said Umberto Eco. I love reading so much; it is probably what drives me to write every week. I read I write and again. The power of reading is like the superpower of projecting oneself outside of the real world; the great benefit of writing is probably the time you give yourself to think and put your ideas together. Think, write, and again.

Questions are more important than answers to find serendipity.

This week, I met with a lot of people and I have enjoyed asking many questions.

What are the questions you asked this week?

#3. How to prospect & sign mega deals in SaaS?

From this article in French 🇫🇷 Comment prospecter et signer des mega deals en SaaS B2B published in Tribes on February 26, 2022. Written by Thibault Renouf.

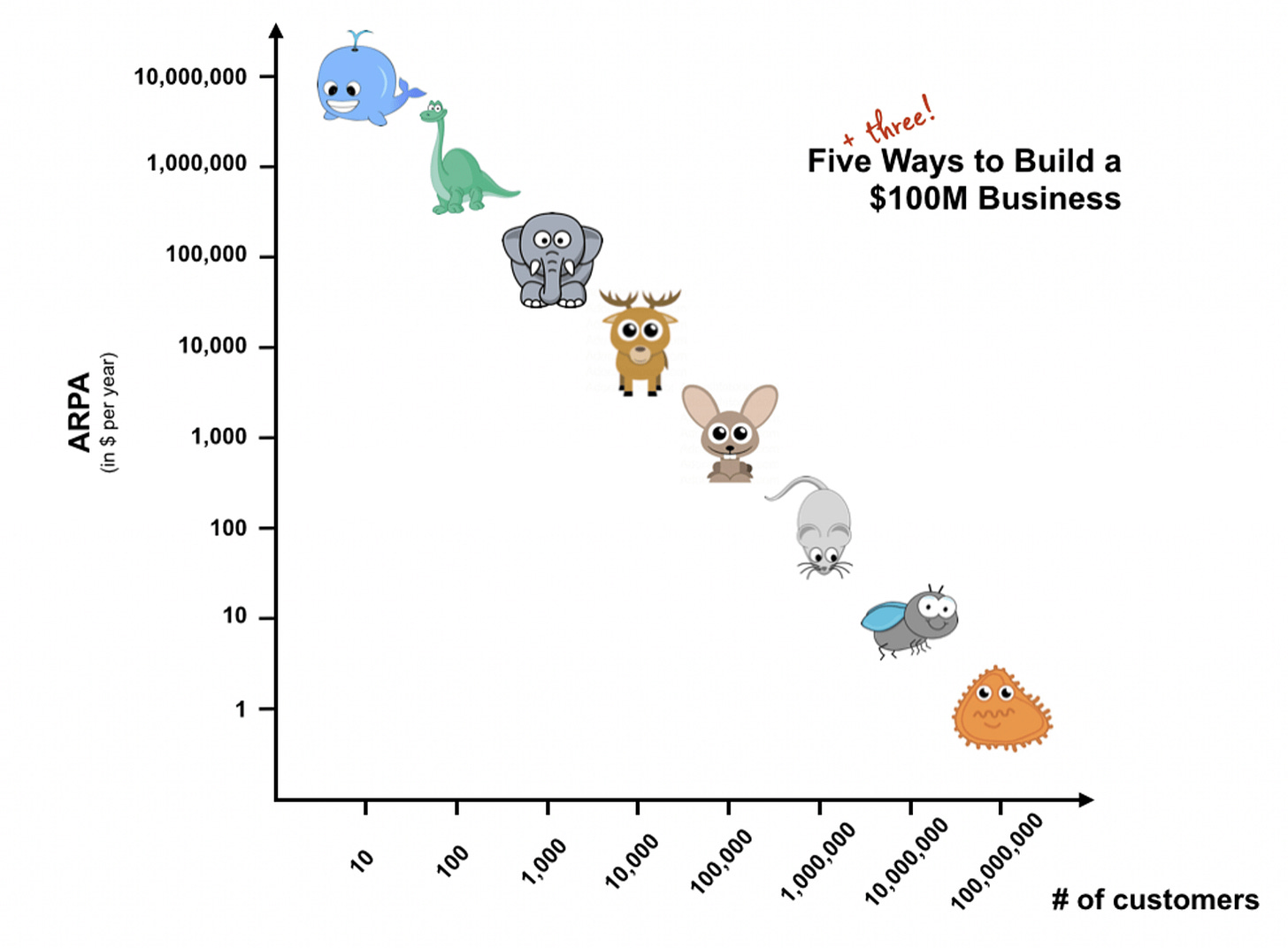

I figured over the past few months that I have developed my expertise in the business of hunting ‘elephants, dinosaurs, and whales’. Do not take me wrong, I love animals and I would never ever hurt one.

I am talking here about winning customers that can bring an important ACV (Annual Contract Value). To be very honest, I am growing aware that there are no startup playbook for winning such (large enterprise) customers; probably because those mega deals are generally not a startup business.

Interestingly, in smaller countries like France, there are no real dinosaurs or whale hunters (ACV above respectively 1Meuro & 10Meuro). While in the US 🇺🇸, we can take as reference Veeva, Workday, or Palantir.

The well-known ‘Spray and Pray’ marketing playbook in SMB SaaS cannot be applied to mega deals where targeted -and highly personalized- account-based marketing (aka ABM) is way more effective. Getting an opportunity with a large corporate company is always a matter of developing a multi-touch sales approach; talk to 5 to 8 contacts at the target company you want to sell to and you will get a chance to get 1 opportunity.

There are key metrics one should look at when dealing with mega deals like:

Having a gross (or logo) churn <8% and a negative net churn (or net revenue retention NRR > 100%),

Customer acquisition costs < ACV (means that break-even is in year 2); this is generally a maximum but holds true if you have an average LTV (Lifetime Value) superior to 3 years. You will also have to factor in your cost of service and your gross margin while calculating your ROI per cohort.

Testing a ‘land & expand’ sales strategy by signing smaller initial contracts and upselling. This may even mean that the 1st deal involves no contract at all (just a purchase order). And this is also how you can win this initial deal without going through the formal, long, and complex process of winning an RFP (Request for proposal). This has the value of building sales velocity and predictability because you remove barriers to winning deals that can usually take long to win and deploy.

From today, this newsletter will be 100% free. You can make us super happy just by sharing it with a teammate, a friend, or a family relative. Just click on the button you see below.

Clicking on ❤️ is even easier. Can you do it?

See you next Sunday!